Navigating Investment Categories: Introducing Our Accredited or Not Infographic

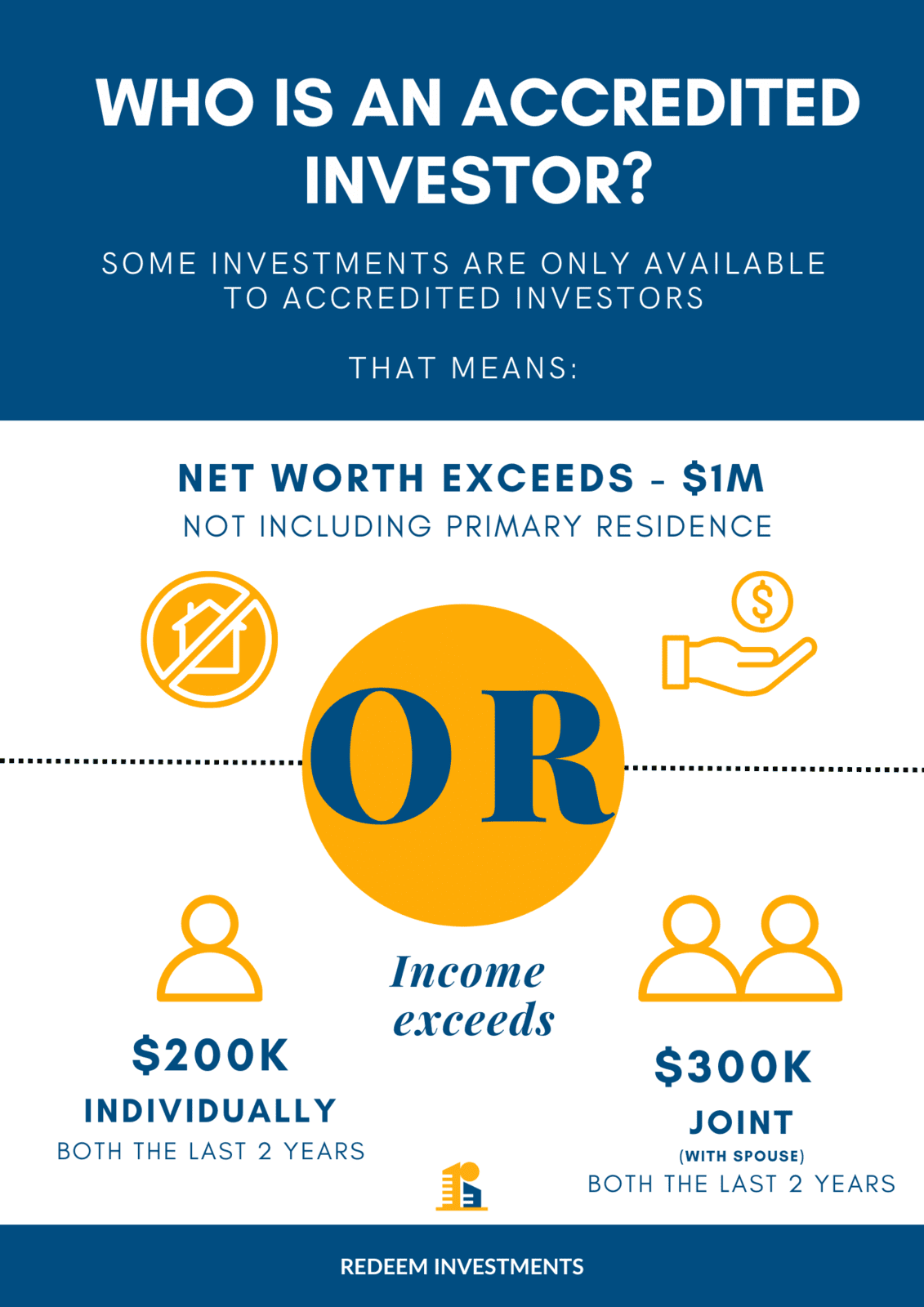

Investing is a journey that's marked by diverse opportunities, but it's crucial to know where you stand in the investor landscape. Whether you're an experienced investor or just beginning to explore the world of financial growth, understanding your investor category can be a game-changer. We're thrilled to introduce our "Accredited or Not" infographic – a valuable tool designed to help investors self-identify which category they belong to. In this blog post, we'll take you through the significance of investor categorization, the key distinctions between accredited and non-accredited investors, and how our infographic simplifies this process.

Why Investor Categorization Matters:

Investor categorization isn't about labels; it's about empowering you with the right information. Accredited and non-accredited investor categories exist to ensure that investors have access to suitable opportunities while adhering to their financial capabilities and expertise. Recognizing these distinctions helps you navigate investment options that align with your risk tolerance, goals, and regulatory requirements.

Accredited vs. Non-Accredited: Key Differences:

Accredited investors possess certain financial attributes that deem them as more experienced and capable of handling riskier investments. These investors meet specific income, net worth, or professional criteria. They enjoy greater access to private investments, with reduced regulatory restrictions. On the other hand, non-accredited investors, while equally important, have fewer financial resources and may be subject to stricter regulatory oversight. Understanding these differences is pivotal for making informed investment decisions.

Introducing Our "Accredited or Not" Infographic:

Our infographic simplifies the process of identifying whether you belong to the accredited or non-accredited investor category. With clear, concise visuals and easy-to-follow criteria, you can quickly determine which category aligns with your financial situation. This tool is an essential step towards understanding your investment standing and gaining insights into the opportunities that best suit your profile.

How to Use the Infographic:

Using our "Accredited or Not" infographic is as easy as 1-2-3:

Access the Infographic: Visit our website to access the infographic. You can find it on our resources or education page.

Self-Identify: Carefully review the criteria presented in the infographic for both accredited and non-accredited investors. Based on your financial status, match yourself with the appropriate category.

Plan Your Investments: Armed with this knowledge, you can now explore investment opportunities that are tailored to your investor category. From stocks and bonds to private equity and real estate, you can make choices that align with your goals.

Empowering Your Investment Journey:

Our "Accredited or Not" infographic is more than just a visual aid – it's a tool designed to empower your investment journey. By understanding your investor category, you can make informed choices, seize opportunities, and navigate the investment landscape with confidence. Remember that investing is a personal journey, and our goal is to provide you with the resources you need to make the best decisions for your financial future.

In conclusion, the introduction of our "Accredited or Not" infographic marks a pivotal step in your investment journey. By understanding the distinctions between accredited and non-accredited investors, you can make choices that align with your financial status and aspirations. Embrace this tool, explore its insights, and embark on a path that leads to informed investment success.